Notes

An Economic Model of Greed (Or, The Legacy of Gordon Gekko)

New York Times

Before Deepwater Horizon there was Thunder Horse, a fifteen story oil platform that cost over $1 billion dollars to construct and was characterized as a marvel of modern technology. According to then Secretary of the Interior Gale Norton, “It is amazing that so large a structure … will have such a tiny environmental footprint, leaving almost no trace of itself in either the sea or the sky.”

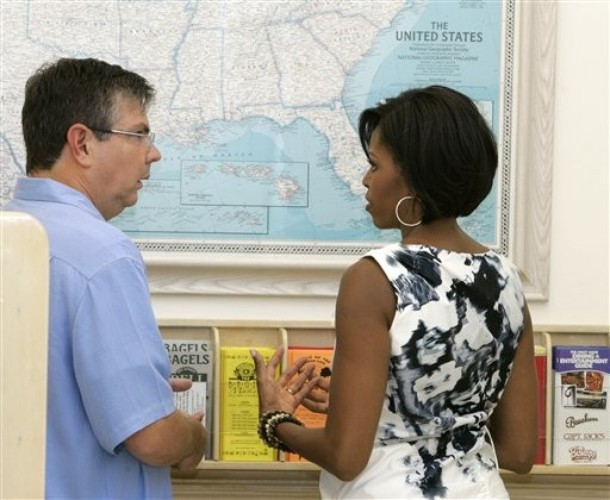

The photograph above shows it pitching in the seas of the Gulf of Mexico following Hurricane Dennis in 2005 before it had become fully operational. The efficient cause of its near sinking was not the storm however, but the improper installation of a check valve that “caused water to flood into, rather than out of, the rig when it heated during the hurricane.” A simple enough mistake, perhaps, until we learn that the platform was hastily rushed into production “to demonstrate to shareholders that the project was on time and on schedule.” And it was later discovered that the shoddy welding of underwater manifold pipes could have led to a catastrophe would have made the current disaster seem small in comparison.

But there is more, for in the same year a BP refinery in Texas City, TX exploded, killing fifteen and injuring nearly 200 more. And again, the cause was “organizational and safety deficiencies at all levels of BP.” The next year BP was responsible for the leaking of 267,000 gallons of oil on Alaska’s North Shore. And yet, once again, the accident was foreseeable and avoidable. In total BP ended up paying over $300 million dollars in fines. No small amount until you compare it against their net profit for 2007 of $20.84 billion dollars (admittedly, a sharp decline from the previous year but more than enough to absorb the fines and still leave enough to pay investors a substantial dividend; aka “the cost of doing business”).

There are two points to be made. The first and more obvious point concerns what the photograph above (and others like it from the Texas City explosion and the leak in Alaska) actually shows. The evidence of the impending disaster of Deepwater Horizon was literally before our eyes at least as early as 2005, but we chose not to see it. After all, progress entails bold risk, and where would we be without oil. It is just the most recent iteration of modernity’s gamble, the wager that the long-term dangers of a technology intensive society will be ultimately avoided by continual progress. Sure, safety is important, but … And as they say, the proof of the pudding is in the tasting, as we dole out fines that amount to little more than a slap on the wrist.

The second point is less obvious precisely because it is harder to visualize, and it is all the more important because of that fact: the economic model that is driving such decision making is not guided by anything even approximating the rationality of free markets or the law of supply and demand, but by the same culture of greed that has driven the world economy to its knees in recent times. As one British economist put it, BP was run like “a financial company, rotating mangers into new jobs with tough profit targets and then moving them before they had to deal with the consequences. The troubled Texas City refinery, for example, had five managers in six years.” Without putting too fine of an edge to it, we’ve learned in recent times that that is no way to run the financial sector, let alone an oil conglomerate.

In the end, the photograph of the listing Thunder Horse Platform might be the proper visual rebuttal to Gordon Gekko’s now famous declaration, “Greed, for lack of a better word, is good.”

crossposted at No Caption Needed

Reactions

Comments Powered by Disqus