Notes

The Mortgage Meltdown: We Missed It Completely… Because We Knew It All Along!

But even in hindsight, I think it would have taken a miracle for business journalists to have foreseen the current crisis in its magnitude and depth. Beat reporters saw the pieces of it, and columnists who took a broader view warned about the buildup of risk. But even those who predicted disaster, I think it’s fair to say, didn’t know how widespread it would become or how unprecedented the government’s reaction would be. A New York Times editorial warning in September 2006 that “in a market so vast and dynamic, everyone knows that if mortgage defaults should rise, damage could reverberate throughout the financial system,” probably didn’t leave many readers thinking seriously that two years later we might be talking about a second Great Depression. (from: What We Learned In the Meltdown by Martha M. Hamilton (CJR)

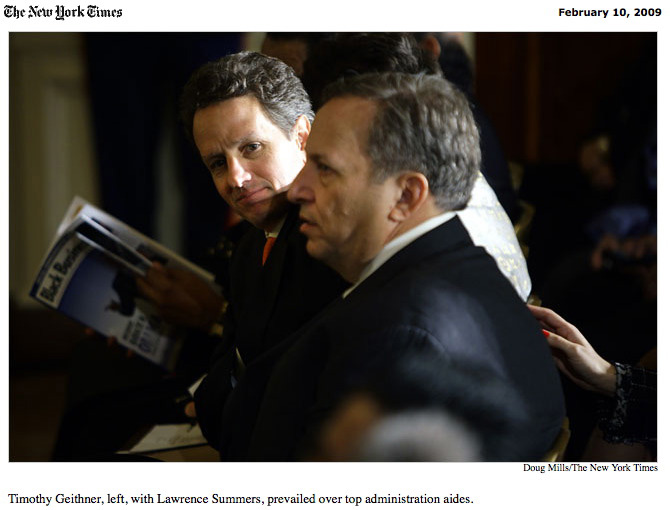

Reading this quote this morning (via Floyd Norris) — the same day Treasury Secretary Geithner delivered the latest economic sick bed medicine — it reminded me of a BNN post way back on June 20th, 2005 reproduced below it its entirety.

In contrast to all those scratching their heads right now over how they could have predicted this absolute catastrophe, the post draws out a couple of points. 1.) The term “meltdown” was already in circulation. 2.) It was common wisdom that this market was going to crash. 3.) Sadly, because the crash was so long in coming (held up, we now know, by all that banking jujitsu), the impending crash was actually dismissed as taken for granted.

*************

Maybe it’s supposed to be a brick — but a brick is solid.

Maybe it’s supposed to be a concrete block — but a concrete block has a two hollow cells in the middle.

Maybe it’s supposed to be a basement extruded from the ground with the house removed — but a basement wouldn’t have sloping interior sides.

Or, maybe it’s something else. Maybe a trough. Yes, a real estate trough!

If there is no way to tell what this thing is, it could be because the event everyone is predicting has been granted substance without a form. At this point, it seems there isn’t a major news publication that hasn’t gone on record as predicting a housing meltdown. In a funny way, however, the media obsession only exemplifies a reverse version of the same group think that took hold during the dot com mania. Only in this case, the only thing certain is that the sky will fall.

If this brick-like thing indicates confusion about the nature of the catastrophe, its altitude suggest just as much ambiguity about its timing.

Consider the height of this object. Because the viewer is situated at eye level with the clouds, and the thing is even higher than that, this object is pretty high. (It’s like you were sitting in the window seat of a large passenger jet and this was your view out of the window.) The suggestion is that the meltdown might still be far from hitting the ground.

As much as there is concern for the housing market, however, what these incessant predictions are really about is fear. But not fear for the housing market specifically, so much as the fear that yet another blow might befall America that would once again catch people “out of the know.”

What I think TE really should have put on this cover was not a building material-like object, but an actual bubble. Because that is what people are expecting to burst. As a general defense, the country has embraced the fantasy that nothing bad can happen — just as long as we name the threat in advance, and then expect it to arrive.

(image: The Economist Magazine. June 18, 2005)

Reactions

Comments Powered by Disqus